Tag Archive: Financial Planning

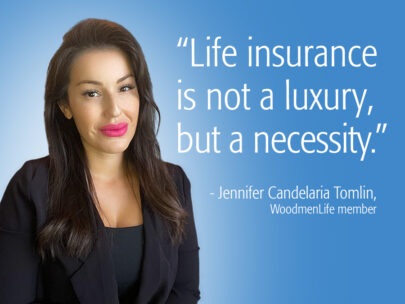

WoodmenLife Member: Why Life Insurance Matters to Me

Life is a beautiful journey, but it's also full of uncertainties. That’s why life insurance matters. We all want to ensure that our loved ones are taken care of, not just while we're here, but also when...

Read More

WoodmenLife Members’ Food Truck Business Is a Family Affair

WoodmenLife is there for our members at every stage of life. The Bahers offer a prime example: Though the Alabama family is now living out their dream, their journey has had its ups and downs. WoodmenLife...

Read More

A Guide to Family Term Life Insurance

When it comes to protecting your family's financial future, Family Term life insurance is a popular choice for young families. Let’s explore Family Term life insurance to help you determine if it's the right option for...

Read More

WoodmenLife Can Help Lighten the Load of Student Loan Debt

Student loan debt in the United States has surged in recent years, becoming one of the country's major forms of consumer borrowing. Although the benefits of a college education typically outweigh the costs, many graduates are...

Read More

Take Control of Your Finances During Financial Literacy Month

April is Financial Literacy Month. Financial literacy is the ability to understand and use financial skills, including making responsible financial decisions, effective budgeting, saving, and investing for the future. Here, we take a look at one key...

Read More

How One Member Found the Freedom to Volunteer in Retirement

June is National Annuity Awareness Month. The goal of this month is to increase awareness about the important role of annuities as part of a secure retirement savings plan. Continue reading to see how an annuity...

Read More

LawAssure’s Online Will Template Makes Planning Easy

No one likes to think about what happens when they’re gone. But it’s important to have a plan, and most Americans don’t have one. Case in point: Only about 32% of us have a will1. One of...

Read More

Feb 22, 20242/22/2024

Learning Center

Valentine’s Day + Insure Your Love = A Perfect Pair

By Gary Peterson, Senior Copywriter February is a month full of love, with Valentine's Day being the highlight on the 14th. It's important to remember that February is also Insure Your Love Month. Whether you’re married, a...

Read More

Start the New Year Strong: Make Purchasing Life Insurance Your Top Priority

A new year means new resolutions. Your resolutions may include exercising more, eating better and reducing stress. The new year is also the perfect time to reflect on your financial goals and, if needed, do a...

Read More

Life Insurance Protection a Key Need for Young People

More than 4-in-10 Americans said they don’t have enough life insurance protection, according to the 2023 Life Insurance Barometer. That number goes up to almost half for America’s youngest adults: 49% of Gen Z and 47%...